If you would like to re. The DLA is a balance sheet.

3 Amount Owing To Directors The Amount Due To Directors Are Unsecured Interest Course Hero

That is an amount owing by a director to the company.

. Classification Of Bank Loans In The Balance Sheet. The two columns show the due to and due from accounts. I am filing my company accounts LTD Micor Entity.

The charge used to be 25 but it went up when the the dividend tax rates went up. The director may loan the company 1000 to pay a supplier or cover working capital requirements he may also pay for several items of stationery and postage on behalf of the company using his own cash. Recording Shareholder Loan Payback.

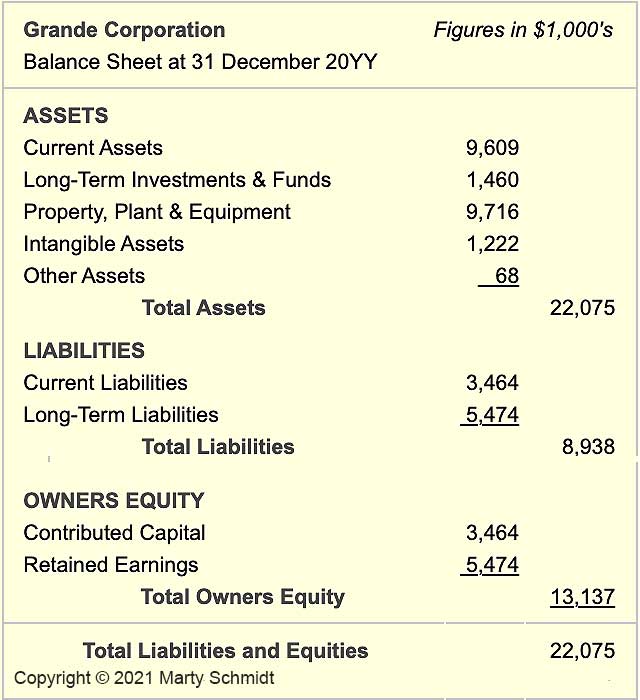

I took a loan of 4k from my LTD Company as Director and paid back within 9 Months so no Tax implications. The ledger is divided into two columns. Whether a loan from the company to a shareholder is permissible and on what terms is dependent on the decision of the board of directors.

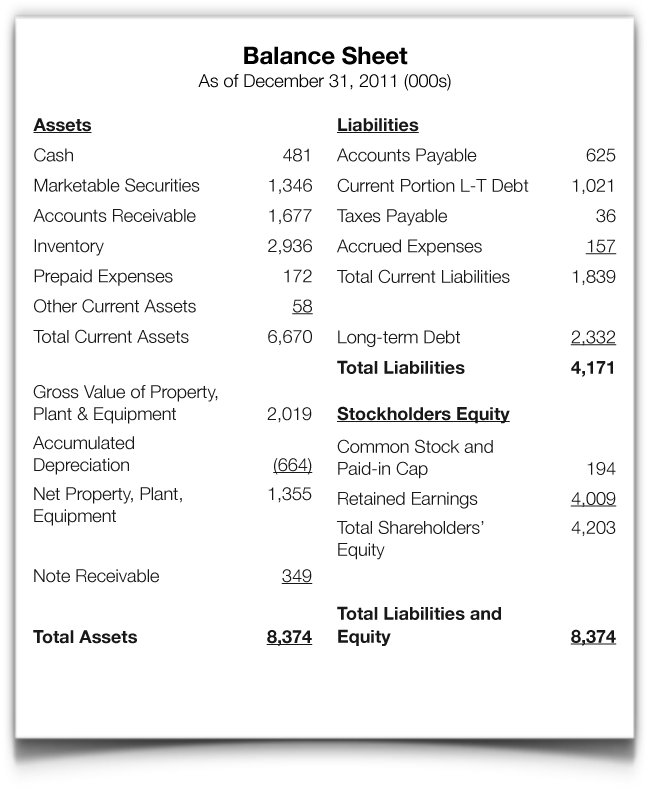

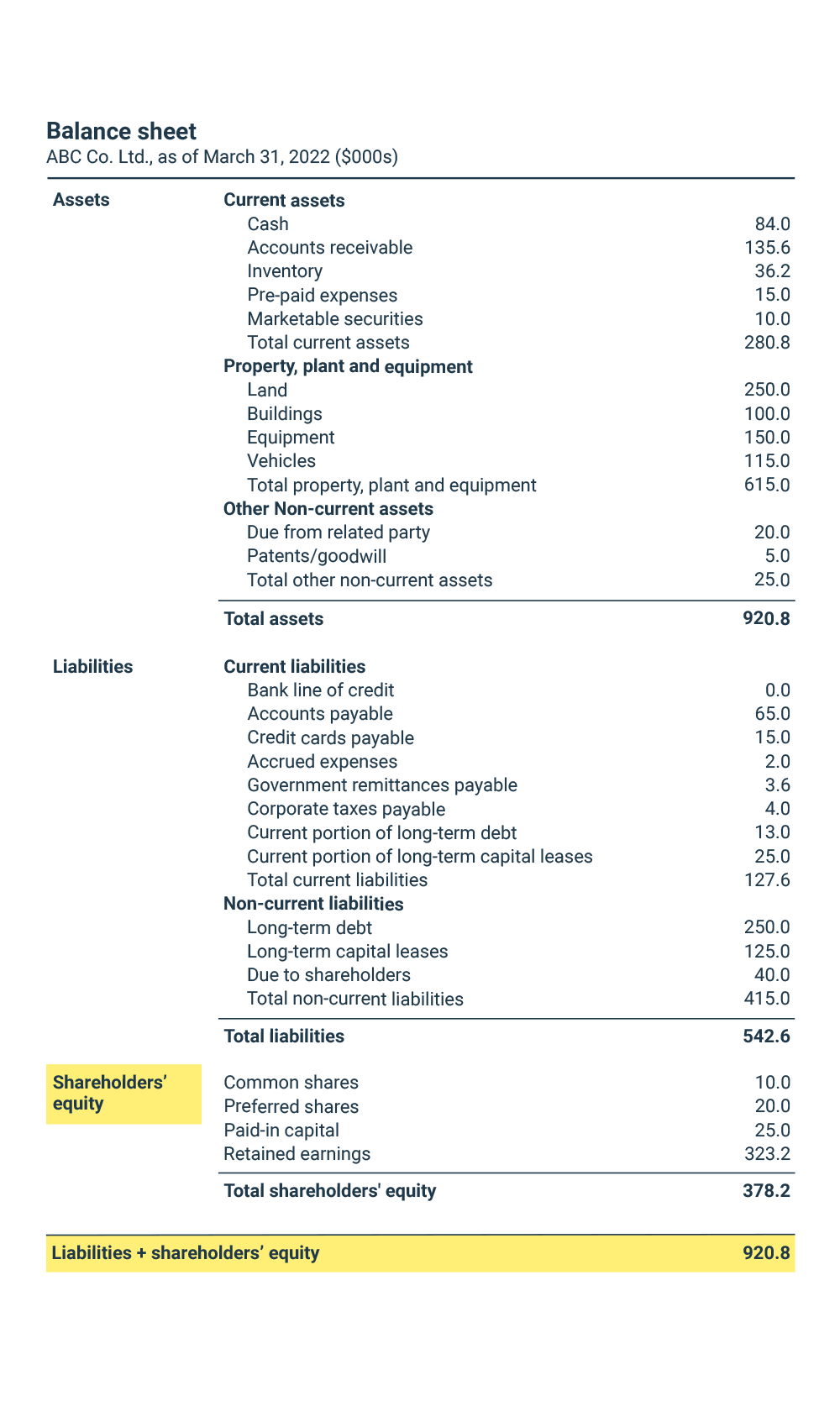

So pay yourself 5000 per month but take 1000 only with the balance being set against the loan account. So it is an asset of the company that is recoverable by a company or the companys liquidator. A separate note receivable account should be created and named Due from Shareholder to separate this type of receivable from other receivables from the ordinary course of business.

Balance sheet - amount due from directors. On 01 April the remuneration committee decide to pay the 10000 to each director. The trial balance rolls up the information from the general ledger which includes all the financial accounts of a business.

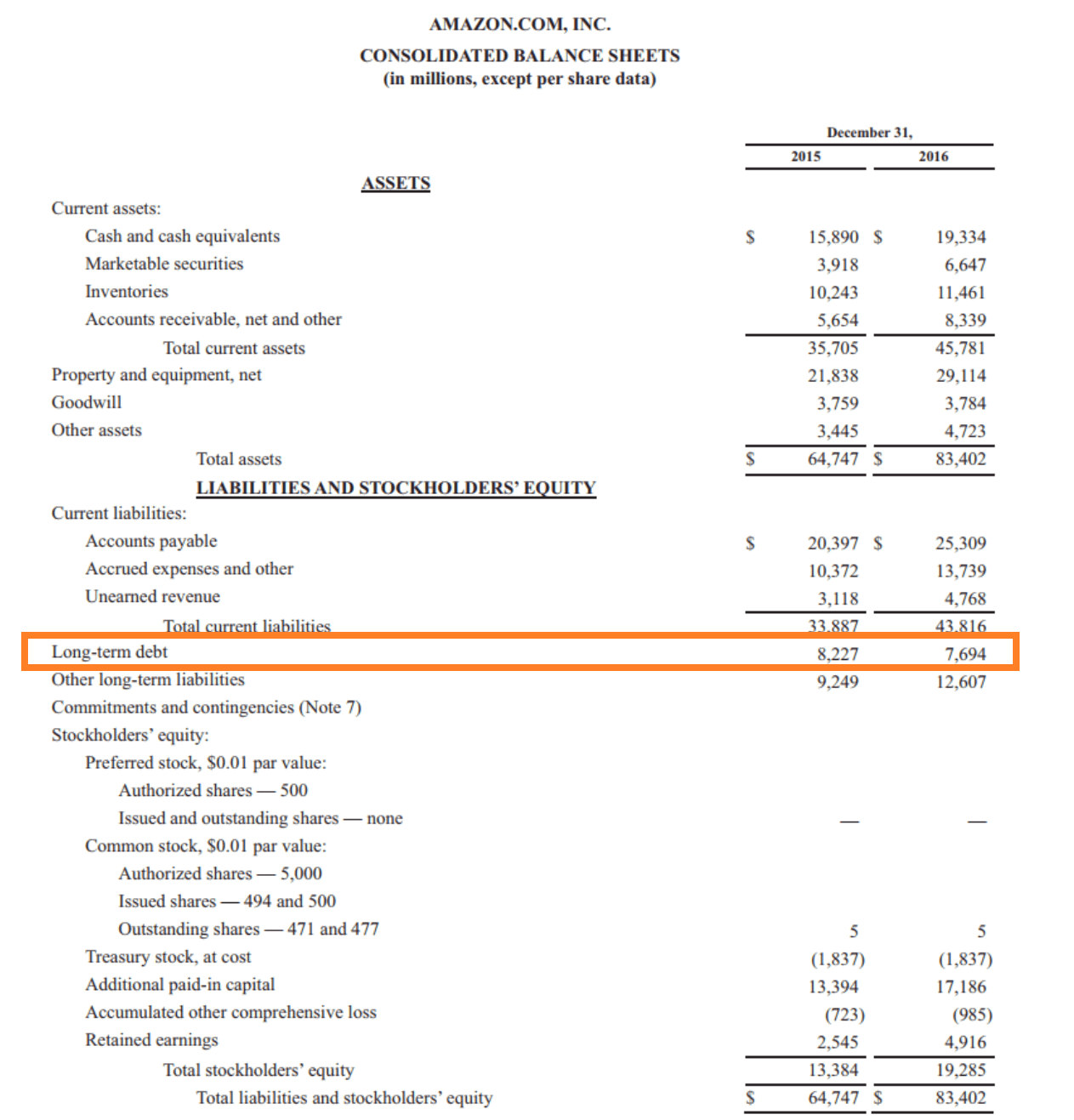

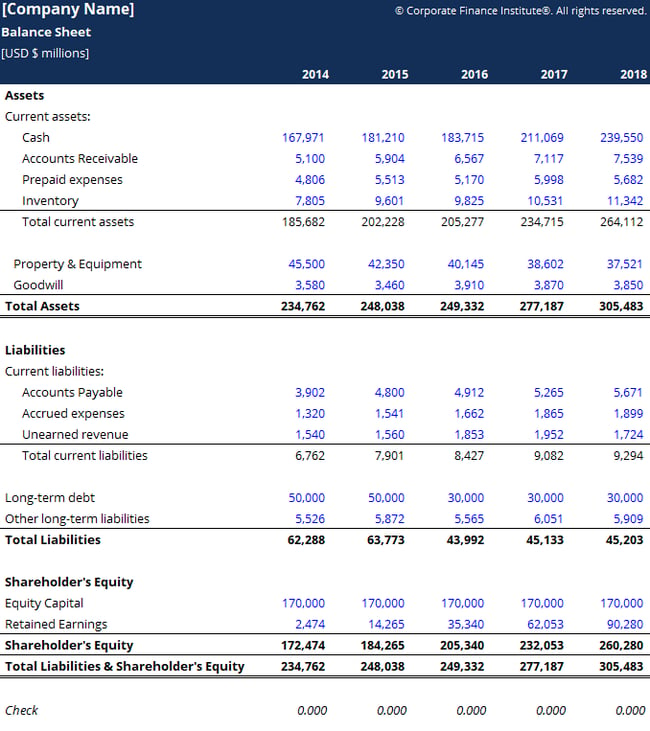

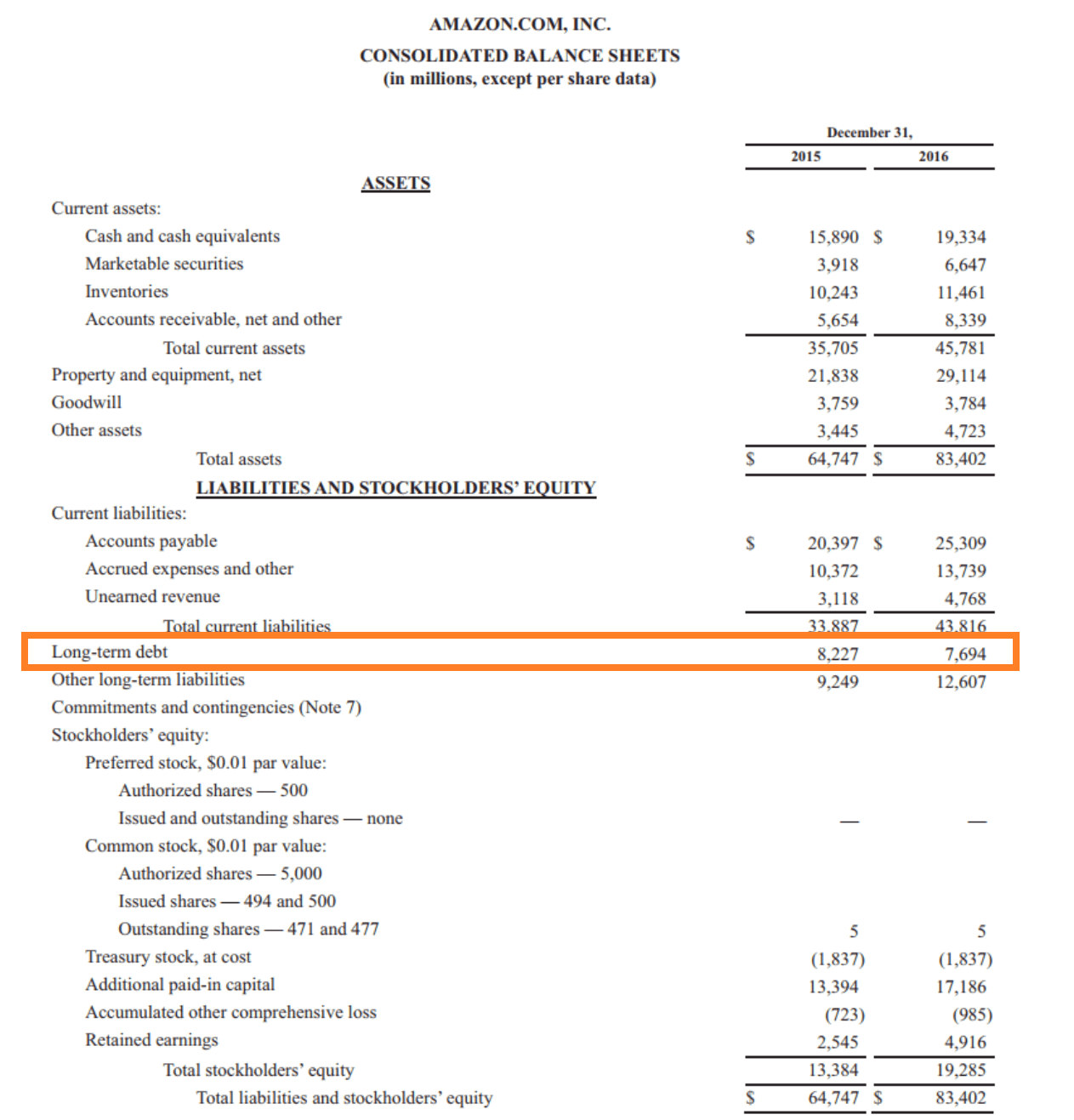

The bank loans that are due in more than 12 months are recorded as the non-current liabilities of the business entity. In this case one balance sheet liability account employee reimbursement has been increased by 200 reflecting the amount due to the employee. The Due from Shareholder receivable account may be paid within one year or it could carry a balance for a significantly longer amount of time.

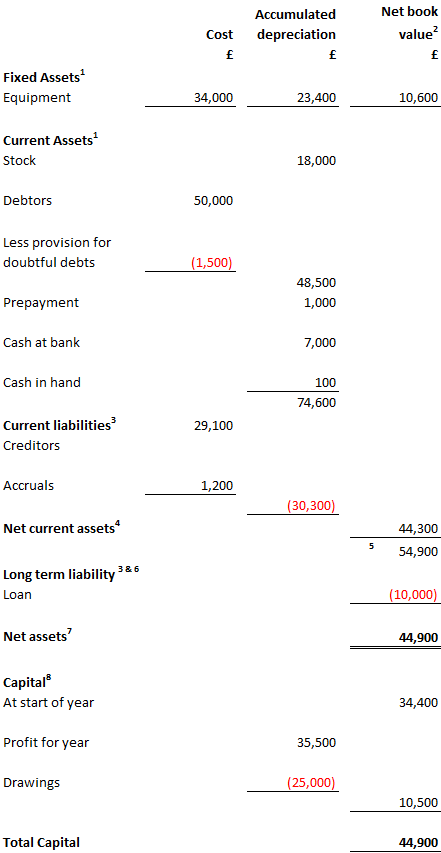

The amount owed to or from the director. Surely the directors loan would have to be treated as a creditor and the other side of. Free Trial - Track Sales Expenses Manage Inventory Prepare Taxes More.

However due to the payment process and cash flow issue the payment is delayed. Companies are liable under section 455 of the Corporation Tax Act 2010 to pay a 325 tax charge on loans to directors and certain other individuals that are not repaid on a permanent basis within nine months of the end of the companys accounting period. On 20 April the company has made a payment of 50000 to all directors.

22 Sep 2008 1 what does this item represent in a balance sheet. Liability accounts are accounts that show the amount of money that is owed by the business. If you create this account under Account type of Current Liability you would only be able to post the amendments as General Journal.

The DL is paid back within 9 months after financial year end. Tax is charged on the remaining balance. To my surprise the other accountant had recognised a 15k directors loan as a type of equity in this companies balance sheet.

Ad For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online. If the loan is to be paid back in less than one year the receivable should be part of current assets on the balance sheet. Shareholders of a company do not owe the same duties and responsibilities to the company that a director does.

Due to this there are no legal restrictions concerning loans from the company to a shareholder. This seems madness to me. Where there is more than one Director in the.

In other words we classify bank loans under the liability side of a balance sheet. I have one issue about the Dirctor Loan. The DLA is a combination of cash in money owed to and cash out money owed from the director.

Company ABC has 3 executive directors and 2 non-executive directors. Often a companys financial accounts will show directors loans. However I do not know how to do the right reporting when filing for the.

Withdraw money from your company thats not part of your salary an expense or a dividend and the amount is more than you invested.

How To Read Understand A Balance Sheet Hbs Online

How To Calculate Total Assets Definition Examples

What Is The Current Portion Of Long Term Debt Bdc Ca

Understanding Company Accounts Corporate Watch

Insights European Gateway Eg Newsroom

How To Create A Projected Balance Sheet Presenting Forecast Assets And Liabilities

How To Read A Balance Sheet Complete Overview

How To Put Balances To Manager S Profit Loss Account Items Manager Forum

Balance Sheet Provides Insights For Debt Collection

Balance Sheet Example The Law Student Blog

The Balance Sheet Accounting 4 Business Studies Students

Understanding Company Accounts Corporate Watch

Long Term Debt Definition Guide How To Model Ltd

What Is Shareholders Equity Bdc Ca

Owners Equity Net Worth And Balance Sheet Book Value Explained

Balance Sheet Explained Maslins Accountants Maslins Accountants

/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)